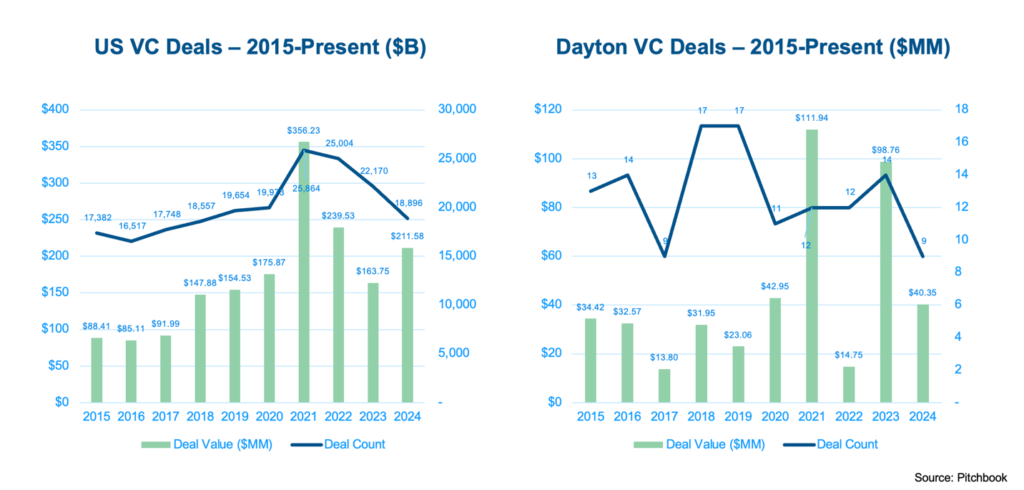

Uncertainty continues to shape the broader economy, and startups seeking venture investment are navigating an evolving landscape. Nationally, venture capital (VC) deal volume declined for the third consecutive year from its 2021 peak, while total VC dollars invested saw a modest rebound in 2024. This shift—fewer deals but slightly more capital deployed—suggests a growing concentration of investment in later-stage startups.

Dayton’s 2024 VC Landscape

For Dayton-based startups, 2024 presented a mix of challenges and milestones in venture fundraising. According to PitchBook, Dayton-headquartered startups raised just over $40 million in total funding. While this figure falls below 2023’s mark—primarily because of multiple large late-stage 2023 deals—2024 saw a record for seed-stage financing, based on data from PitchBook and the Entrepreneurs’ Center (EC). This surge in early-stage investments underscores Dayton’s growing momentum, laying a strong foundation for future high-growth startups.

2024 EC Fundraising Client Highlights

Several EC-supported startups made notable fundraising strides in 2024:

- Unlisted raised $2.25 million

- Niobium closed $5.5 million

- $3.6 million in total funding was awarded to 18 startups through Ohio’s Technology Validation Startup Fund (TVSF), with support from EC

2025: A Look Ahead

While the fundraising environment is expected to remain competitive, startups with strong business models and clear market traction will have an edge. Dayton’s investment pipeline for 2025 is taking shape, with an eight-figure deal pipeline projected for Q2 alone.

At Entrepreneurs’ Center, helping startups access capital—whether through venture investors or state and federal grant programs—remains a top priority. If you’re a startup looking for funding, we’d love to connect.